Client Personalization.

At Scale.

Introduce Automation Into Your Practice.

Your Clients And Stakeholders Will Thank You.

Features

Ongoing Client Updates

Automatically identify relevant life events, idiosyncratic risks, preferences, and other unique client factors.

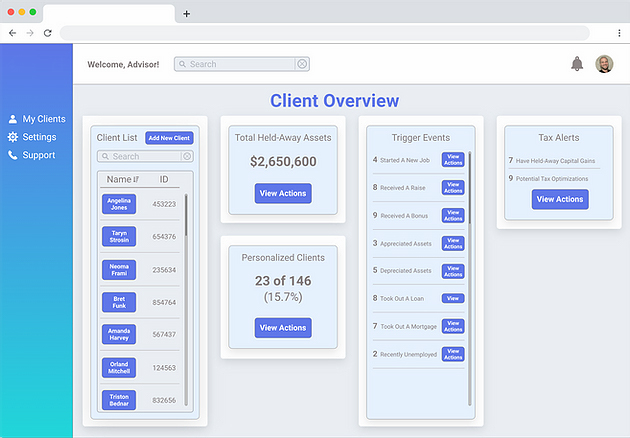

Client Analytics

Firm-wide client analytics provide powerful data-driven insights to increase relationships and serve business decisions.

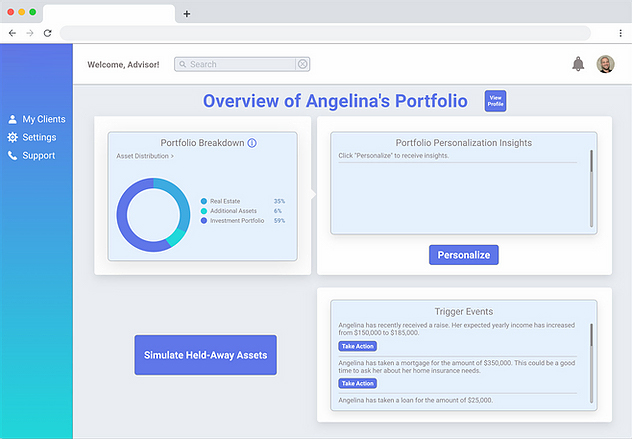

Acquire Held-Away Assets

Use hard numbers to demonstrate the impact of personalization on each client's financial life.

Auto-Personalized Actions

Set rules across your firm to govern specific client events, at scale. Events will be identified and handled based on your preferences.

Attract New Clients

Clients deserve, and demand, hyper-personalized service. Empower your advisors to offer it to them.

Seamless Integration

N3 seamlessly integrates with your existing software. Technology should match your needs, not the opposite.

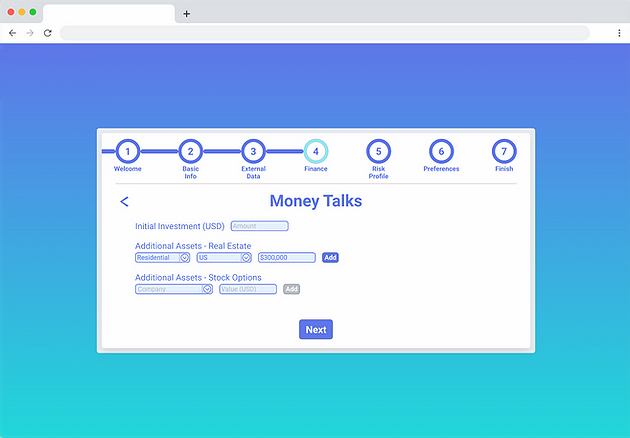

How it works

Learn

Each client is different.

Identify and track actionable, unique client events in real-time.

Next Best Action

Prioritize advisor activities to align with business goals and client financial health to grow your business.

Automate

Deliver Family-Office level service to each client through highly customizable automations.

Real-Time

Client Data

Gain insights into each client:

Life events

Holistic wealth picture

Idiosyncratic risks

Personal preferences

Deep demographics

Specific Client

Overview

Deep-dive into the client data that matters

Actionable events

Automated modeling,

governed by your rules

Aggregated Client Dashboard

View and take action on your book of business - at scale

Triggers help you identify opportunities, scored by likelihood and value

Save time while improving client outcomes

Schedule a Demo

Do you have questions about our products or would like to see how N3 CAN can help your organization?.

Drop us a line and we’ll be delighted to speak.

Your details are kept strictly confidential as per our Privacy Policy.